Hi Guys

Just wondering if we have any central coast locals/investors online?

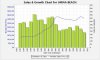

I can't see whats wrong with this place (Umina beach)

On the southern end of the central coast, so very close to jumping on the freeway, or close to Woy Woy station for a quick commute to Sydney.

Beaches/bushland/relaxed lifestyle/and an ok commute to Sydney (express trains run from Woy Woy via the North Shore line to North Sydney or via Strathfield to central) - all in just over 1 hr

House pricing: 3 bed/brick veneer/10mins walk to Umina Beach...mid $300's!!

Surely this place has a future?

Any comments?

Any tips appreciated!

cheers

Sam

Hi Guys

What a surprise! We have been found. Although the high flyers bought weekenders over the hill at Pearl Beach. People like Andrew Denton, David Hill,Jeannie Little, David Williamson, John Singleton, the list goes on.

We have been residents and business owners in Umina for over 24 years. We came here from the Northern Beaches as a young couple with child, and another on the way. Myself and two older brothers owned the Umina Beach Newsagency from 98 to 2004. It's a good place to live, I love it. We do get bad press frequently, because of a small segment of troubled youth. I used to wrap papers in the early hours of the morning 24/7, and we saw a bit of trouble, but usually the Police moved them on. Club closing time was always the peak time for trouble. But the cops had it in hand. Kudos to those guy/gals. We have a large retirement population, and they can get a bit anxious. Often overplayed.

We owner built our PPOR on the hill overlooking the town and waterways back in 83. The block was $26,500 the house was $35,000. We turned it into a duplex in 88 and recently had it revalued at $620,000. This could be higher as we have yet to do some small reno work to it.

When we came here, you could buy a waterfront with wharf at Booker Bay for $120,000. In fact, we bought a block just below us for $8,500 on the hillside in 84. It was on for $10k and even in the midst of a recession, we just thought that this was the most amazing bargain. So we hocked ourselves beyond our eyeballs and struggled on.

We have had many expat friends sayiing exactly what you have said. These people were cashed up and moving in here, for the very reasons you have stated. The fast ferry fiasco, that was meant to be running from Ettalong to Circular Quay, sank without a trace. It couldn't work, as the cost could only be borne by the Govt, making huge losses.

Job oppotunities are scarce, but most commute anyway. I love the close proximity to Sydney. As an investor, we have always used the buy and hold strategy, and history tells us we have done well.

So in answer to your question Sam, yes this place has very good prospects.

Often opportunities are overlooked, when they are right in front of your face.

Cheers

pendo