Fair enough, even though $290,000 is not a 30th percentile house in a city.

(although my personal opinion is that $290,000 house is generally not a unreasonable starting point for the textbook definition average family on 70k family income-although as you are aware, I believe the increasing numbers of two income families skew the family income figures higher, and this is not a true representive of average.

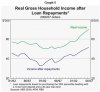

If we plug in todays data though it's a very different story, and the trendline(by the RBA definition), would be a sharp dip downwards,even allowing for an 5% increase in wage growth. Adding to that, wage growth will NOT match inflation over the next 3-4 years, and therefore the increase in disposable income argument will become irrelevent, and in some instances, move backwards.

Sorry keith. I want to let it go, but you know how it is..